Retirement

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

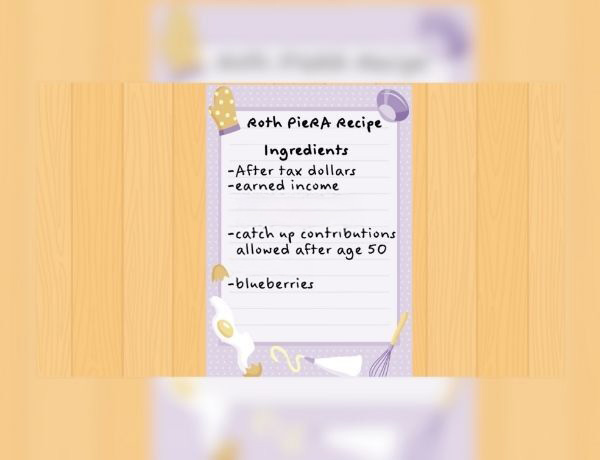

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Have A Question About This Topic?

Retirement Redefined

Around the country, attitudes about retirement are shifting.

Catch-Up Contributions

Workers 50+ may make contributions to their qualified retirement plans above the limits imposed on younger workers.

Retirement Plan Detectives

A couple become Retirement Plan Detectives, searching records from old employers.

Helpful Retirement Strategies for Women

Learn how to address the challenges that women face when planning for retirement.

How Retirement Spending Changes With Time

It can be difficult for clients to imagine how much they’ll spend in retirement. This short, insightful article is useful.

Retirement Is a Beginning

Key questions to answer when you are considering retirement.

Retirement Traps to Avoid

Beware of these traps that could upend your retirement.

Exploring Retirement Plans for Small Businesses

Help small businesses make better retirement decisions for employees with this eye-catching and informative infographic.

Six Surprising Facts About Retirement Confidence

This attention-grabbing infographic covers retirement topics you may not have considered.

View all articles

My Retirement Savings

Estimate how long your retirement savings may last using various monthly cash flow rates.

Roth 401(k) vs. Traditional 401(k)

This calculator compares employee contributions to a Roth 401(k) and a traditional 401(k).

A Look at Systematic Withdrawals

This calculator may help you estimate how long funds may last given regular withdrawals.

Inflation & Retirement

Estimate how much income may be needed at retirement to maintain your standard of living.

Self-Employed Retirement Plans

Estimate the maximum contribution amount for a Self-Employed 401(k), SIMPLE IRA, or SEP.

Annuity Comparison

This calculator compares a hypothetical fixed annuity with an account where the interest is taxed each year.

View all calculators

Dreaming Up an Active Retirement

When you retire, how will you treat your next chapter?

What You Need to Know About Social Security

Every so often, you’ll hear about Social Security benefits running out. But is there truth to the fears, or is it all hype?

Retiring the 4% Rule

A portfolio created with your long-term objectives in mind is crucial as you pursue your dream retirement.

Retirement Plan Detectives

A couple become Retirement Plan Detectives, searching records from old employers.

Retirement and Quality of Life

Asking the right questions about how you can save money for retirement without sacrificing your quality of life.

Retirement Redefined

Around the country, attitudes about retirement are shifting.

View all videos

-

Articles

-

Calculators

-

Videos